Why isn't my property tax coming? What to do if you don’t receive a property tax receipt? Who should pay

Have you already received a letter from the tax office? If not, we recommend reading the article.

Until December 1, citizens of the Russian Federation must pay so-called property taxes. These include:

- transport tax,

- land tax,

— property tax (apartment, house, dacha and even garage).

If earlier we were not particularly attentive to “chain letters,” now taxes have risen, fines are increasingly burdening the family budget, and we have more and more questions. Let’s first understand how the tax authority notifies Russians of necessary payments.

Tax authorities can send you notice in several ways:

- personally against signature,

- by registered mail,

— by email or through your personal taxpayer account on the official website of the Federal Tax Service of Russia.

If you are registered in your personal taxpayer account, you will receive a tax notice only in electronic form. If you need a paper letter, you can make a request for it through your personal account. However, for this you must have an electronic signature, which is issued at MFCs (multifunctional centers that can be easily found by the “My Documents” signs).

So, let’s figure out what to do if the tax office has not sent you a notice by the end of November:

Case 1: Previously, the letter from the tax office arrived regularly, but this year it did not arrive, or it arrived, but not all objects are listed there.

Actions: Before December 1, contact the tax office at your place of residence in person for notification. Or do it simpler: leave a request on the website www.nalog.ru using the “Contact the Federal Tax Service of Russia” service (subsection “Electronic services” in the “Individuals” section). Fill out the form, explaining your problems, wait for an email notification that your request has been accepted. That's all - then it's up to the tax office. They will reschedule your payment or duplicate the notification. From the moment the new notification is generated, you will have another 30 working days to pay.

Case 2: you have never received a letter from the tax office, but you have an apartment/car/land/dacha.

Actions: on the one hand, until the notification is delivered to you, you are not obliged to pay tax (clause 4 of Article 57 of the NKRF), however, you are obliged to inform any tax authority about the availability of property before December 31. A special application form can be downloaded from the website www.nalog.ru (in the subsection “Submitting a Report on the Availability of Property” in the “Individuals” section). The application must be accompanied by copies of all documents confirming your rights to the property. You can submit the application and documents to the tax office in person, send it by registered mail, send it by email or through the taxpayer’s personal account, certified by an electronic signature. In this case, you will start paying taxes from the year in which you applied to the tax office.

Please note that from January 1, 2017, the “amnesty” ends for those Russians whose information for some reason was not included in the tax database. You are required to independently declare your property to the tax authority. Otherwise, liability is provided in the form of a fine - 20% of the tax amount (clause 1.2 of article 23 of the Tax Code of the Russian Federation and clause 12 of article 1 of the Law of April 2, 2014 N 52-FZ). And such a percentage, you see, can already significantly affect the family budget.

Please note that only those who have paid their taxes in full are eligible!

And don't forget to add "Taxes" to the expense planning section in

Your apartment tax hasn't arrived? What to do in this case? Is it worth panicking? Or is it better to just be patient and wait for the tax notice? We will have to understand all this further. We will also study all the features related to apartment taxes. After all, in Russia not every person encounters this payment. It is important to understand how to check your tax debt and pay it. We will also familiarize ourselves with this topic. In the end, every person will be able to easily cope with the payment and verification of debts to the state.

What it is

So, your apartment tax hasn't arrived? What to do? The answer to such a question will be presented later. To begin with, we will look at all the nuances of taxation in Russia.

Apartment taxes are a type of property levy. It is federal in nature. Paid by property owners (houses, apartments, rooms) annually.

Who should pay

The first step is to find out whether you need to pay apartment tax. As already mentioned, not every person encounters this type of collection.

Housing taxes are paid by all owners of the relevant property. But there are exceptions. They will be discussed later.

If a person is the owner of an apartment, cottage, house, room or share in the listed objects, he will definitely receive a notice of payment of property tax. The exception is for beneficiaries who have declared their rights to state bonuses.

Who doesn't pay

What benefits does the apartment tax provide in Russia in 2017? Some categories of citizens may not pay this fee.

Those exempt include:

- minors (legal representatives pay for them);

- pensioners;

- disabled people;

- veterans;

- Knights of the Order of Glory;

- large families (not always).

In some regions, large families are not completely exempt from property taxation, but only partially. They get discounts. The amount of state support will have to be clarified in each region - it is different everywhere.

Factors influencing calculations

How much is the apartment tax in Russia? There is no way to answer such a question unequivocally. This is due to the fact that various factors influence the amount of payment.

These include:

- type of house;

- living space size;

- year of construction of the building;

- cadastral value of the property.

In fact, everything is not as difficult as it seems. The main problem is obtaining information about the cadastral value of housing. This parameter changes every 5 years. And it depends on the region in which the property is located, as well as on the specific area of the settlement.

About tax calculation

- cadastral value of housing;

- tax rate.

Deductions

It is important to remember that when calculating property taxes, citizens are entitled to a standard deduction. It helps reduce the tax base.

Deductions offer the following options:

- apartment - reduction in the area of the object by 20 m 2;

- room - 10 m2;

- house - 50 "squares";

- a real estate complex with residential premises - reduces the base by 1,000,000 rubles.

That's all. Accordingly, using all the previously listed information, you can answer how to find out the apartment tax.

Rates

But this is not enough. It is necessary to remember about the so-called tax rates. They change from time to time.

The following coefficients are currently valid in the Russian Federation:

- housing costing up to 10,000,000 inclusive - 0.1%;

- 10-20 million - 0.15%;

- 20-50 million - 0.2%;

- up to 300,000,000 - 0.3%.

That's all. But this option sometimes leads to errors. Therefore, many people think in other ways. There are quite a lot of them.

Methods for obtaining data

For example, every modern person can use special calculators. One of them is located on the official page of the Federal Tax Service. With its help, by specifying the parameters of the property, you can see the amount of the upcoming payment.

In addition, it is proposed to obtain data on the amount of tax:

- by checking through online services;

- by contacting the Federal Tax Service;

- by looking at the information in the payment order.

In reality, everything is not as difficult as it seems. And with proper preparation, neither calculating apartment taxes nor receiving the relevant data automatically will cause any trouble.

Due date

The current legislation of the Russian Federation establishes a specific deadline for the payment of property taxes. In 2017, it is necessary to transfer this or that amount before December 1 inclusive.

If the owner did not manage to cope with the task, he will have to face sanctions. The apartment tax calculation will include an additional penalty. And the longer the delay lasts, the more you will have to pay in the end.

How to check taxes

Do I need to pay tax on an apartment that has not been privatized? No. Citizens must pay only for the periods of their stay as homeowners. If there is a social tenancy agreement, tax obligations do not pass to the residents of the apartment.

Many people are interested in how to check apartment taxes. This can be done in the following ways:

- personally contact the Federal Tax Service;

- use the official website of the tax service;

- work with the Gosuslugi service;

- use the “Payment for Government Services” service;

- search for debt on the website of the bailiffs of the Russian Federation.

In addition, the amount of the upcoming payment can be seen in the payment notification. In fact, everything is not as difficult as it might seem at first glance. And even a novice user can cope with searching for data on property taxes.

About payment methods

How to pay tax on a privatized apartment? There is no clear answer to this question. Modern citizens are allowed to act in different ways. Everyone decides for themselves the procedure for depositing funds into the state treasury.

Here are the most common methods for solving the problem:

- through "State Services";

- by working with the website "Payment for State Services";

- Internet banking (Sberbank Online and so on);

- in cash through bank cash desks or at the Federal Tax Service;

- through payment terminals;

- through ATMs;

- using electronic wallets.

You can also use various third-party tax payment resources, but this is not recommended. The Internet is full of deception.

Working with State Services

Let's consider several options for checking tax debts. For example, with the help of "State Services". This service helps not only to receive state and municipal services, but also to pay bills, fees, and taxes.

The step-by-step procedure can be imagined as follows:

- Register on the gosuslugi.ru service. Additionally, you will have to confirm your identity. This takes about half a month.

- Log in to your profile on State Services.

- Open your “Personal Account” and familiarize yourself with the information displayed on the screen. We need to look at the field labeled "Property Tax".

- This is only one of the options for the development of events. You can do it differently:

- Open "Government Services".

- Go to the block "Public Services" - "Federal Tax Service" - "Tax Verification".

- Click on the "Get service" button.

- Indicate the full name of the citizen with place of residence or TIN.

- Click on the data search button.

Within a few minutes, information about all tax debts will appear on the screen. This way you can not only view the data, but also pay your bills immediately.

Federal Tax Service and website

It is proposed to check the tax of individuals on an apartment differently. For example, through the “Personal Account” on the website of the Federal Tax Service of the Russian Federation. This is the fastest and most reliable method.

To implement it you will have to:

- Get access to "LK". This can be done at the Federal Tax Service or at the MFC. A citizen must have a passport and TIN certificate with him.

- Open the website nalog.ru.

- Click on the “Login” button in the right corner.

- Enter the data from your “Personal Account”.

- Go to the "Accrued" tab.

All tax debts will be displayed here. You need to pay attention to the field labeled “Property Tax”. This is what we need!

Reasons for lack of payments

The apartment tax hasn't arrived? What to do? It all depends on the situation. There can be many reasons for this phenomenon. And the algorithm of action will always be different in a particular case.

Why hasn't my apartment tax arrived? Most often this happens due to:

- system failures in the Federal Tax Service;

- that the time has not yet come for sending out notifications;

- whether a citizen has a profile on “State Services”;

- violations of the Russian Post;

- recalculations;

- lack of data on real estate in the tax authorities (most often occurs when we are talking about new buildings).

Innovations in the Russian Federation

And yet, why didn’t the apartment tax arrive? The first and most common reason is that a person has a profile on State Services.

From 2017, citizens registered on the mentioned service will not receive paper notifications. Data is provided to them only in electronic form. But a person will be able to print a receipt via the Internet.

No payment - is there a tax?

Is it necessary to pay apartment tax if a citizen has not received a corresponding notification?

The answer is yes. The absence of notifications does not cancel tax obligations. And they must be paid for on time. Otherwise, the citizen will face penalties and debt, which will increase in size every day.

When are notifications sent?

Also, if the apartment tax does not arrive, what should you do? You can just wait a little. In Russia, notifications in the prescribed form are sent out at certain times. And therefore it is possible that the deadline has not yet come.

Current laws oblige the Federal Tax Service to send out tax payment receipts no later than a month before the end of the payment period without consequences. That is, in our case it is November 1. After such a date, decisive action can begin.

There are no notifications - what should I do?

Your apartment tax hasn't arrived? What to do? It is recommended to wait until November 1st and then take decisive action.

Here are some tips to help solve the problem:

- Remember whether the person has a profile on State Services. If the answer is positive, you need to restore access to it and study the information on debts.

- Create a taxpayer’s personal account and obtain the necessary data from there.

- Wait. It is possible that payment bills have not yet been sent out.

- Call or go to your local Federal Tax Service office. There you can clarify information about the operation of the tax alert system, as well as find out whether payments have already been sent out. The Federal Tax Service may also issue a receipt for further payment of the apartment fee.

- Search for information via the Internet. The majority of methods allow you not only to pay receipts online, but also to print the relevant documents.

In any case, you can’t wait until December 1st. Otherwise, the person will have to overpay for the delay. This is not the best thing and can always be avoided.

Results

We found out how to behave if a citizen has not received a notification from the Federal Tax Service about property tax. Situations like this are happening more and more often.

Important: citizens pay taxes for the previous year. That is, you will have to pay for an apartment purchased in 2016 in 2017, and so on. Therefore, the lack of payments should not always cause panic.

The state structure is distinguished not only by its love of bureaucracy, but also by its very dubious punctuality. In any case, when taxes have not arrived, the average citizen does not know what to do. But he understands perfectly well who to blame - the officials who are unable to do their job. But is everything really that bad or could there be objective reasons for delays?

Implementation of electronic systems

For many centuries, our ancestors relied only on paper for everything related to documentation. The Internet and electronic media did not appear yesterday or even the day before, but their full implementation into public life is proceeding at too slow a pace.

Today there are thousands of websites of various ministries, administrations and territorial divisions of various organizations:

- You can make an appointment by pressing just a couple of buttons and without sitting in line for hours, for example on the Gosuslugi portal;

- There is an opportunity to get advice online;

- Some of the notifications and notices, if desired, can be “ordered” into your electronic account;

- Some payments can be made without looking up from the screen.

But all this does not relieve the postal service so much and does not get rid of dozens of pieces of paper - receipts, notifications, payments.

In a number of Baltic countries, as an experiment, the government carried out the transition of its activities from the “paper” field to electronic media. This reduces the degree of bureaucracy, but, as experience has shown, it does not protect against hacker attacks at all.

Apartment tax does not arrive: what to do?

First of all, don't panic. Secondly, relax and enjoy:

- The taxpayer is obliged to make payment only after receiving the notice;

- The notification must arrive on time;

- It can be delivered personally or by registered mail;

- The notice can be obtained in the electronic “Taxpayer Account” on the tax service website.

Until this happens, you are protected by Article 57 of the Tax Code of the Russian Federation. Specifically, its 4th article, the meaning of which boils down to the fact that if a person has not received a notification from the tax service on time, he should not pay.

From the point of view of the law, you can only be charged tax for the previous three years, without any penalties or fines. So there's really nothing to worry about. In case of litigation, tax authorities have no chance.

You can stand in line at the nearest territorial branch, but why? It’s easier to wait until everything is settled without your intervention.

Why isn't my property tax coming?

There are several reasons for missing payments:

- The tax amount does not exceed 100 rubles, in which case the letter, as a rule, is not sent;

- You did not notify the service that you have taxable property;

- After recalculation, it turned out that in previous years you overpaid;

- Error on the part of the tax authorities.

Make sure you have already received receipts for this apartment or car. In this case, there is absolutely nothing to blame you for and no action is required from you. The busy schedule of tax officials may mean that chain letters are not sent to everyone.

You should also not discount our mail; a certain percentage of letters are lost or arrive very late.

Most often, problems arise precisely because of financial recalculations and too small a payment amount. Don’t worry, sooner or later you will receive your bills and be able to pay them, it’s just not the time yet. Article 57 of the constitution still protects taxpayers from mistakes on the part of government officials.

This is extremely simple - if the letter has not arrived, it means that the payment obligations have not occurred. As soon as you put your signature on the registered letter, that’s it, it’s time to pay the bills.

If you haven't received your tax receipts

Besides ignoring the problem, there are several other options:

- Receive notification using your electronic account;

- Visit the tax office, stand in line and provide copies of documents for the property;

- Call and find out what the problem is.

If the apartment was purchased recently and receipts have not yet been received for it, it is better to spend time resolving this issue:

- Call the tax office;

- Find out the reception time for your question;

- Specify the list of required documents;

- Visit the valiant staff.

This action will relieve you of any liability. Until 2015, a citizen was not required to “surrender” on his own, but a change in legislation made the work of the tax service easier and made life somewhat more difficult for taxpayers. Now it will not be possible to blame everything on the oversight of officials, and in case of litigation, problems may arise.

In all other cases, you can spend time either calling or visiting your personal account on the service website. This action will not take more than a couple of minutes, but will help solve the problem no less effectively than visiting the department itself. The main thing is not to worry about possible fines; in this regard, the taxpayer is well protected by the law, and if you are sure that the problem arose not through your fault, sort it out to the last minute.

Why don't taxes come in and what to do about it?

There are always several options to choose from to solve the problem:

- Call the nearest tax office and find out the reason;

- Visit the tax authorities yourself;

- Log in to your email account on the website;

- Nothing to do.

The last option, oddly enough, is almost the most correct:

- They can collect tax from you only for the last three years;

- Payment obligations become effective only upon receipt of receipts;

- There can be no talk of any fines if there were no notices;

There may be several reasons why the “letter of happiness” never fell into your hands:

- Error on the part of the tax service;

- Problems at the post office;

- The payment amount is less than 100 rubles;

- Overpayment for previous years;

- The tax authorities are not notified that you have property, the possession of which is being collected.

In the latter case, it is better to notify the service. How to understand whether they know or not about your financial condition? Look for receipts from previous years. If they came, then everything is fine and there is no need to worry. If they are not there, it is better to go and show documents confirming ownership.

If you haven’t received your taxes yet again, you can find out what to do from a lawyer you know. Any specialist will say that until the notice is served, all responsibility lies with the tax service, that this is their problem.

Video: what to do if there are no notifications from the tax office?

This video will tell you when tax notices should arrive and what to do if you haven't received them:

If you own any real estate, you are familiar with the annual chain letters from the IRS. Each owner is required to pay property tax, according to the notification received, until December 1 of the current year. Otherwise, a penalty in the amount of 1/300 of its part will be charged daily on the invoiced amount. But how can you pay your apartment tax if you haven’t received a receipt and neither the exact amount to be paid nor the recipient’s details are known? Let's look at the methods that exist today.

Pay a visit to the tax office

The easiest way to clarify the amount of the mandatory contribution and receive a receipt is to contact the tax authority at your place of registration directly. By presenting your passport and TIN, you will be able to obtain the necessary information. The tax officer will also print out a duplicate payment receipt for you, which can be presented at any bank.

Important! Since 2015, contacting the tax authority if a receipt has not been received is the responsibility of every payer.

According to clause 2.1 of Article 23 of the Tax Code of the Russian Federation, every citizen who has not received a receipt is obliged to report this to the tax office at the place of registration of the property. This must be done no later than December 31 of the current year. The application for the absence of notification must be accompanied by copies of documents confirming your ownership of the real estate. Two categories of citizens are exempt from this obligation:

- those who have already received a notice of tax payment for this apartment at least once;

- those who have applied for tax benefits.

That is, if you recently purchased real estate, in the absence of a receipt, you should contact the local Federal Tax Service to check whether they have made changes to the database. But if you have owned your home for more than a year and have already paid taxes on it, you will not have to write a statement about the absence of a receipt.

When to start panicking

Notifications about property contributions begin to arrive to citizens in September. However, the law specifies exactly when property tax receipts arrive. The deadline for receiving a payment is 30 days before the deadline for payment. That is, if the treasured letter has not arrived by November 1, there is no need to panic, even if all neighbors have already received notifications. Perhaps the letter was delayed in transit due to postal service failures.

In addition, even in the absence of notification, you can still fulfill your tax payment obligation. And for this you do not have to visit the Federal Tax Service.

Where can I find out the amount due?

You can clarify the amount of the property contribution billed for payment remotely via the Internet. There are several handy resources for this:

- official website of the tax service;

- State Services portal;

- Sberbank personal account;

- FSSP data bank.

The last point concerns those taxes that are already overdue. But on the first two resources you can get data even on those deductions that are just awaiting payment. There you can print out a receipt, which you can later use to make payments in a convenient way for you.

How to work with the Federal Tax Service website

To clarify the amount of the property contribution through the Federal Tax Service website, you need to create a personal account on this resource. This will require the following steps:

Important! The citizen’s personal TIN number is used as a login for working with the Federal Tax Service account. The password is issued directly by the tax office at the place of registration after presentation of the passport and the corresponding application.

To find out what apartment tax you need to pay, after logging into the Federal Tax Service account you will need to find the item in the menu "Overpayment/debt". The system will show you the amount to pay and also give you the opportunity to print the payment order.

Working with the State Services portal

Users of the popular service gosuslugi.ru can use it to obtain information about accrued taxes and pay them immediately. To do this, you need to log in to the website and fill out an application to receive debt data in your personal account. In the application you will need to indicate your TIN; the system will take the rest of the data from your profile.

Information about invoices issued by the Federal Tax Service will not be immediately available. Typically, the State Services service takes about an hour to check. You can, after some time, look into your personal account again to read the answer. But it’s much more convenient when sending an application to indicate the method of notification of search results:

- via SMS to a mobile phone;

- via email.

Having received a notification from the portal, you can either print out a payment order to pay the tax in a way convenient for you, or make a payment directly through State Services. The portal makes it possible to make payments using bank cards of the MasterCard and Visa systems, as well as the electronic payment system Webmoney.

Method for Sberbank clients

If you have a personal account in the Sberbank Online system, you can use it to pay real estate taxes, even if there is no receipt. To do this you will need to perform the following steps:

The system will search its database and show you the taxes due. Next, all you have to do is follow the prompts in your personal account to create a payment order and make payment for it.

Important! You can make contributions to the budget through Sberbank Online@ain only from debit accounts. You won't be able to pay taxes with a credit card.

Please note that in this way you can pay a property contribution not only for yourself, but also for any person whose TIN is known to you. Sberbank provides this opportunity; it does not require that the TIN of the person to whom the tax is calculated matches the data of the owner of the personal account.

Method for clients of other banks

Many financial organizations, following the example of Sberbank, provide their clients with the opportunity to search for information on accrued taxes by TIN number. The main thing is that the bank itself has information about this number. Most often, by default this service is available to the following categories of persons:

- salary clients;

- borrowers of a banking organization.

If you simply use your bank’s debit card, or keep a deposit with it, the bank may not have information about your taxpayer number. However, it's worth checking out.

Log in to the personal account of the banking organization whose services you use. Find the section in it that allows you to make payments and transfers. Next, find the subsection “Fines and taxes”, “Payments to the budget” or with a similar name. Depending on the interface, subsections may be named differently. In case of difficulties, refer to the user manual of the personal account or call the hotline of the banking organization.

If the bank has information about you, a form will open in the required section asking you to search for outstanding taxes by TIN. If the banking organization does not have such information, a corresponding message will be displayed.

By the way! In this case, you can also call the hotline and ask the operator to add your TIN to the database or clarify how this can be done. Then next year you will already have access to a search and payment system through your usual personal account.

Well, if a search by tax certificate number is available, then everything is simple: enter the number in the search form and wait for the bank’s response. Next, select the one you need by name from the list of issued payments, create a payment order and finally make a payment from your account.

When making payments, take into account the processing times at your bank. It is possible that the payment will be processed within 3-5 business days and will be received by the Federal Tax Service after the deadline. Try not to delay payments until the last day.

Important! Unlike Sberbank, most banking organizations give their clients the opportunity to pay only their own taxes. Most likely, it will not be possible to search using someone else’s TIN.

Method for clients of electronic payment systems

How to pay apartment tax if there is no receipt and you do not use bank services? Many people are accustomed to making financial transactions through electronic wallets, for example, Yandex.Money. This system also allows you to pay taxes using your TIN number. Moreover, it, like Sberbank, does not care whose number the user enters.

But there is one catch - when searching by TIN, Yandex.Money sees only overdue payments. That is, until December 1 of the current year, without a receipt, you will not be able to find a notice of property tax in them. The reason is simple - until this date you have no debts. In December, the data will appear, but a penalty will already be charged on the amount invoiced.

Other payment systems do not have a search function for invoices issued to the user from the Federal Tax Service at all. Payment can only be made using the receipt number or the details specified in it. Therefore, in this case, in order not to delay the process and not risk getting the reputation of a defaulter, it is still worth contacting the tax service to receive a payment document.

08/13/2019 , Sashka Bukashka

There are several ways to pay tax without a receipt:

- Generate a payment order online on official websites.

- Make a payment via online banking.

- Pay via Yandex.Money.

The post office, alas, loses letters, even official ones. And citizen taxpayers are obliged to pay the budget annually for tax obligations - to pay on time for:

- property;

- transport;

- land.

The Federal Tax Service notifies taxpayers of debt amounts no later than 30 days before the end of payment deadlines. That is, if the deadline for transferring the debt for a car is October 1, therefore, the Federal Tax Service must send payment documents no later than September 1.

I haven’t received a tax receipt, what should I do?

If you have not received a corresponding notification from the Federal Tax Service about your outstanding tax liability, this does not mean that you do not owe the state anything.

You can check your debt and print a receipt for paying taxes using your TIN on the official website of the Federal Tax Service. The procedure is simple and does not take much time. You will need a TIN, a mobile phone or computer with Internet access and a bank card. You can also generate a receipt for tax payment through the State Services website.

IMPORTANT! For personal income tax (personal income tax), notifications for payment are not sent out. This tax is paid for citizens by the tax agent (the employer or other company from which you received income). If the income is received from the sale of property, then in this case the person’s responsibility is to independently file a 3-NDFL declaration and pay the tax. And you will not receive a receipt for paying income taxes in 2019.

We will tell you how to receive a receipt for payment of transport tax via the Internet, since this is the most common tax obligation.

Why don't my tax bills arrive?

The main reasons for the lack of receipts:

- the letter was lost in the mail;

- error or failure in the Federal Tax Service system;

- changing of the living place;

- absence of debt for the taxpayer.

If a citizen has registered on the official website of Gosuslugi, then the Federal Tax Service has the right not to send payment documents through Russian Post. Registration on the state portal already involves receiving receipts and information about debt in an online format.

But registration on the government services portal takes an average of two weeks. And if there are several days left until the debt is due, use the following algorithm.

How to find taxes by TIN, print a receipt and pay

On December 1 of each year we are obliged to pay the state for our property, cars, land. But what to do and how to pay taxes if the receipt has not arrived - in the modern information space this task is easily accomplished. To resolve the issue, we will contact Sberbank’s online banking (if you are its client). The required section is here:

Select the subsection “Search and payment of taxes to the Federal Tax Service”.

To search for tax debts, you need to select the “Search for overdue taxes” service and enter your TIN.

The bank itself will contact the tax database. The whole operation will take a few seconds. After receiving the result, the debt can be paid immediately. Other banks also have similar services (Rocketbank, for example, can track the client’s taxes using the TIN entered in the mobile application and offers to pay them on time).

Payment via Yandex.Money

Another way to pay taxes if there is no receipt is the Yandex.Money service “Taxes: verification and payment”. This is relevant for those who have Yandex.Wallet. But it will also allow others to find out if they have tax debts and pay them with a bank card. You need to enter your TIN in the form provided. In a few seconds the result will be obtained.

The Yandex.Money service allows you to pay property tax without a receipt using an INN, or use a receipt instead of an INN. It is very comfortable.

How to receive receipts for taxes on government services

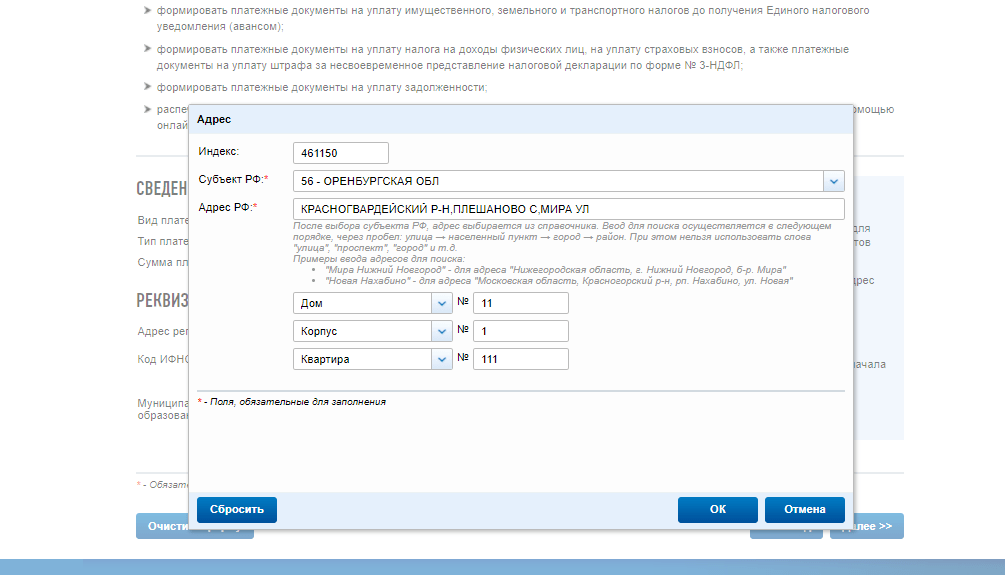

Step 3. Fill in the details of the payment recipient. We enter the registration address. The Federal Tax Service Inspectorate and OKTMO code of the municipality will be updated automatically.

Step 4. We write down the last name, first name and patronymic of the taxpayer, indicate it. We check the entered information and move on to the next stage.

Step 5. We choose one of two available methods of payment for the received receipt: non-cash payment using online payment systems or payment in cash at any bank branch.

For the second option, create a document and print it. For payments through payment terminals, use the UIN - document index in the tax receipt.

You can pay your budget through a Sberbank branch or your personal Internet banking account. In the payment terminal or in your personal account, run a search for debts by TIN. The system will determine the amount of tax liabilities payable. Follow the prompts to transfer funds to the Federal Tax Service.

How to find out the amount of debt

The procedure for paying transport tax without a receipt has been determined. But you need to specify the payment amount. If the tax receipt is not available on the tax office website (did not arrive or was lost), you can find out the amount of the debt in several ways:

- Call the inspectorate or visit in person.

- Register in your personal account with the Federal Tax Service and check your debt.

- Check your debts through the State Services website.

Penalties are provided for citizens for late payments to the budget. Penalties will be charged on the amount of the debt.

Property tax: how to find out and pay

We’ll tell you right away how to pay property tax for individuals if there is no receipt - similar to paying transport tax. Use any method:

- Visit the inspection.

- Contact the taxpayer's personal account.

- Receive a receipt or make a payment through the State Services portal.

- Use the service (online banking) of the servicing bank.

- Do this through Yandex.Money.

As of 01/01/2019, a new opportunity has appeared - not to wait for a notification from the tax office at all, but to pay taxes in advance. This is called a “single down payment”. It is transferred through the taxpayer’s personal account. The link to replenish your advance wallet is on the main page of your personal account.

You can pay in advance any amount (for example, similar to that accrued for the previous year). The system will prompt you to pay it immediately or tell you how to print a receipt for payment of property tax for individuals for payment through a bank.

This advance payment will be used to pay off future taxes on property, land and transport. It is assumed that such an advance will prevent the formation of tax debts and avoid the need to collect penalties and fines.